Recently I’ve received a few emails from prospective students asking about finances and loans. Marc Yambao, the director of Financial Aid, shared with me that 89% of students borrow some form of a federal loan and that the average and median debt respectively from the most recent graduating ND class was $160,804 and $174,097.

I honestly feel like one of the best steps a student can take is to invest in learning opportunities and seminars about business/marketing when they are in school. A few business and marketing classes are included in the curriculum and they provide a structured opportunity to get a head start on making a business plan. Having a plan, knowing what you’re worth, and not being afraid to charge that number is essential in my opinion. Working through any unhealthy relationships with money while you’re in school will remove a barrier for when you’re in practice. I attended this free seminar to help me with that aspect.

It’s really important for students to understand their financial situation in order to have a solid plan for repayment. It’s best to borrow the least amount that you need rather than taking all the loans that are offered to you. I want to walk you through a hypothetical scenario about a single person (not married and without children) graduating with debt and how repayment would work using a student loan calculator.

Crunching the Numbers

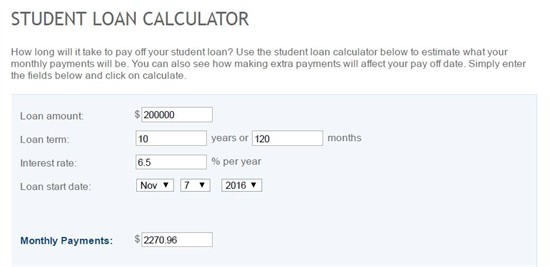

Let’s say you end up borrowing more than average, $200,000, at an interest rate of 6.5%.

To pay back the loan in 10 years, your monthly payment would be just under $2,300/month.

For the sake of the numbers game, let’s say living expenses (insurance, saving for retirement, car, housing, food, spending money, etc.) will be $3,200/month once you’re in practice, so you need to bring in a net of $5,500/month.

Considering malpractice insurance, business rent, marking costs, taxes, and overhead fees, double that number just to be safe…so, you need a gross income of $11,000/month.

Multiplying that number by 12 months makes an annual gross income of $132,000.

There are 52 weeks in a year, but assuming you’d like to have 6 weeks off for holidays, vacations, and sick days, plan on working only 46 weeks/year.

$132,000 divided by 46 equals about $2,870/week of net income.

From what I’ve researched, the going rate for a naturopathic physician in many areas is $125/hour. Dividing $2,750 by $125 equals 23 billable hours of patient care per week. This may be considered as nearly full-time when adding in time spent researching cases, marketing, and clerical work, during which you aren’t getting paid.

To reiterate, this is a hypothetical scenario and all factors are variable. If you work while you’re in school or if you’re married and/or have children, your loan amount may be more or less. Interest rates constantly change (they’ve been between 6-7% for the last three years). The cost of living varies depending on where you go. The lifestyle you want to live will impact your monthly expenses.

There are also different repayment options available such as stretching out the repayment length, using an income-based repayment plan, starting with slow payments and increasing them as time goes on, and more. Therefore, I encourage you to play with the numbers based on your individual situation, and reach out to the Financial Aid Office if you have any questions.

As our hypothetical scenario shows, paying back your student loans on a standard 10-year repayment plan is possible.

0 Comments